/ Blog

We’ll be diving into the metrics that will keep the finger on the pulse of your business.

Thibault Catala

Aug 17, 2023

Thibault Catala is the founder and Managing Director of Catala Consulting. Thibault helps hoteliers maximize asset value and elevate hotel success through expert revenue management consultancy.

With more options for consumers than ever before, the hospitality industry is ultra competitive. So, how can you measure commercial success and ensure you’re ahead of the competition?

We’ll be diving into the metrics that will keep your finger on the pulse of your business.

We’ll begin on the revenue management side of the business by defining and comparing RevPAR to Net RevPAR and similar metrics.

What is RevPAR?

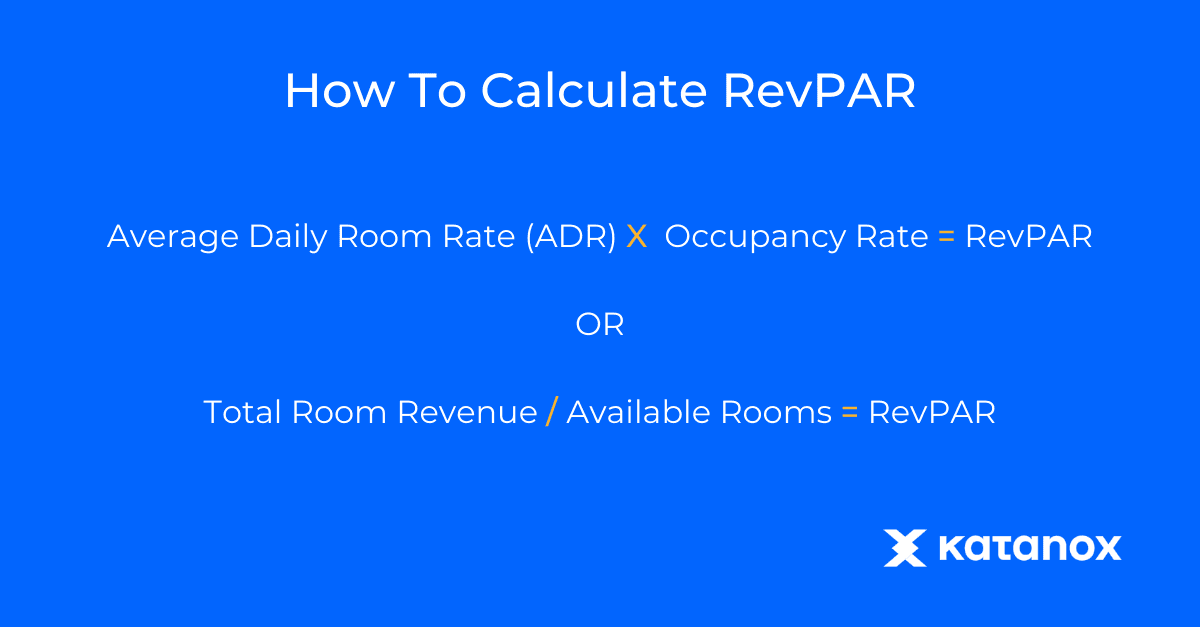

RevPAR is a key indicator of the commercial success of a hotel’s operations. RevPAR stands for revenue per available room. This metric is calculated by multiplying a hotel's average daily room rate (ADR) by its occupancy rate.

Alternatively, RevPAR can be calculated by dividing a hotel's total room revenue by the total number of available rooms in the period being measured.

Let’s look at a simple example. Let’s say a hotel has 100 available rooms and sells 90 of them for an average of 150 USD, totaling 13,500 USD. If we divide that by the 100 total rooms, we get a RevPAR of 135 for that day.

Alternatively, you could multiply the average room rate of 150 USD by the 90% occupancy rate (.90) and arrive at the same RevPAR of 135.

RevPAR assesses a property's ability to fill its available rooms at an average rate. An increase in a property's RevPAR means that either its average room rate or its occupancy rate has improved. This can be a useful barometer to derive the price of a room.

As a standalone number, RevPAR doesn’t provide many takeaways. Therefore, it’s best used as a comparison.

A hotel can compare its RevPAR statistics over a specific period of time to see whether its performance fluctuates with seasons, based on local events or trends or due to changes in travel demand. It can also give insights into how a hotel compares to its competitors in the area.

Shortcomings of RevPAR

While RevPAR tells part of the story, it doesn’t tell the whole story, and therefore isn’t a perfect metric. Just because a hotel has a high RevPAR doesn’t mean it’s performing optimally.

RevPAR fails to consider the size of a hotel. Therefore, RevPAR alone is not a good measure of overall performance. A hotel may have a lower RevPAR but still have more rooms that earn higher revenues.

In addition, certain larger rooms (i.e. penthouses) may overcompensate for lower quality rooms that are not being checked or are unavailable.

Therefore it is best to also consider the occupancy rate of each booking class of rooms.

Another major variable missing from RevPAR is expenses. It could be that a hotel has seen a large increase in RevPAR, but only because of spending more on items such as media, marketing, and distribution.

Enter in Net RevPAR

This is why RevPAR is often accompanied by Net RevPAR — to adjust for the costs of distribution. This is very important because of the high and sometimes hidden fees of not only distribution but also payments.

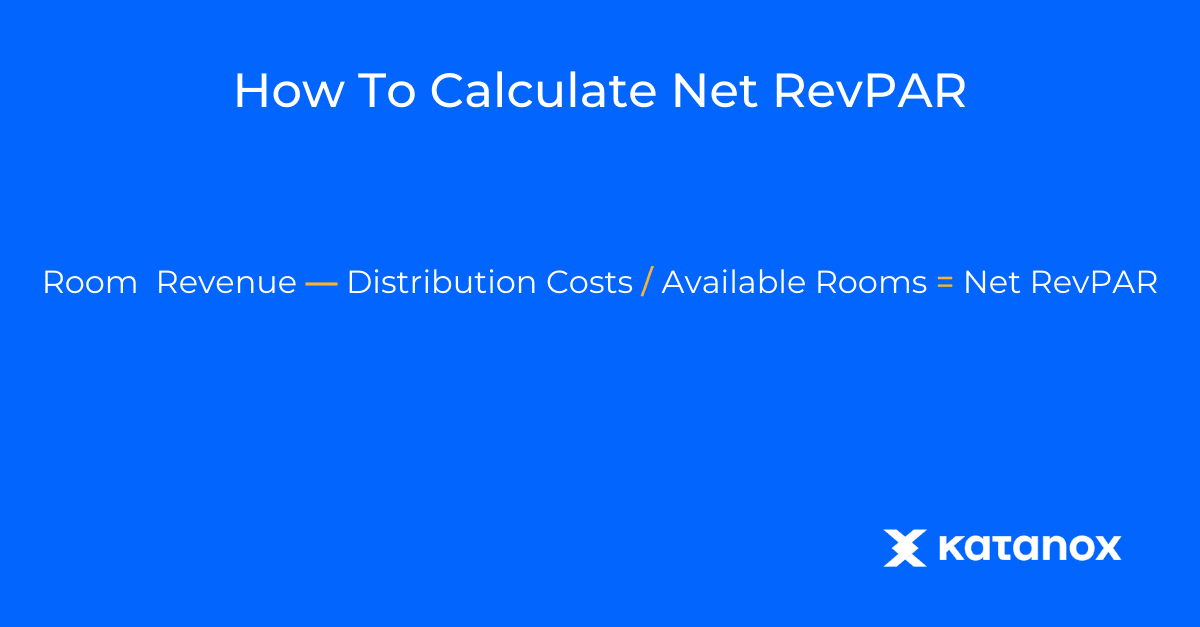

Net RevPAR is used as part of a wider revenue management strategy, helping hotels to assess their overall business performance. Net RevPAR refers to the room revenue generated minus any distribution costs.

Net RevPAR is calculated by subtracting distribution costs from room revenue and dividing by the number of available rooms.

For consistency, let’s take the same number from our RevPAR example and calculate Net RevPAR. Let’s say distribution costs amount to 3500 USD.

That leaves us a net revenue figure of 10,000 USD (subtracted from the gross revenue of 13,500 USD). We then divide that by the 100 rooms to get a Net RevPAR of 100 USD.

This can be an illuminating metric when looking at the big picture. For example, our example hotel could be generating a RevPAR of 150 USD through their GDS partner and think it’s a great distribution channel when comparing it to its total RevPAR of 135 USD.

However, that GDS could be charging 60 USD in fees per room, making the Net RevPAR 90 USD, 10 USD lower than your average Net RevPAR.

It’s important to understand your costs just as much as your revenue, so you can get a more complete picture of your operation.

Other Metrics to Consider

While we’re on the topic of having a holistic view, let’s examine a few other metrics that are worth tracking.

Of course, when looking at revenue, the room is only part of the story. We also need to account for ancillary revenue such as restaurants, spas, room service, etc.

That’s why TRevPAR (Total Revenue Per Available Room) and ARPAR (Adjusted Revenue Per Available Room) are useful metrics.

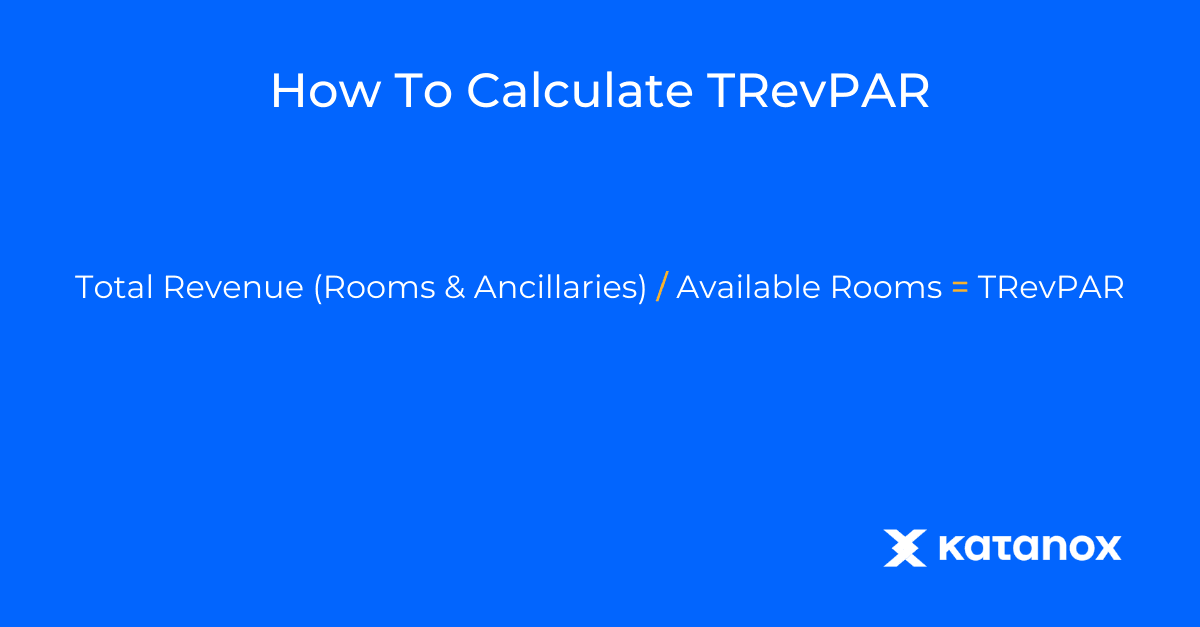

As the name suggests, TRevPAR is the counterpart to RevPAR, but instead of accounting for just the room rate, it also includes ancillaries.

To calculate TRevPAR, simply divide total revenue (from rooms and ancillaries) by the number of available rooms.

Using our original example, let's say in addition to the 13,500 USD generated by the rooms, the hotel generates an additional 4,500 USD from ancillaries. When that’s divided by the 100 available rooms, we get a TRevPAR of 180 USD.

Similarly, ARPAR is the counterpart to Net RevPAR, taking into account costs along with room revenue and ancillaries. ARPAR factors in both variable costs and ancillary revenue.

Traditionally it subtracts average daily rate by variable expenses such as the cleaning, utility, water, internet, TV, and supplies expenses. However, we find it more valuable for commercial teams to instead subtract distribution costs, so we’re making a slight alteration.

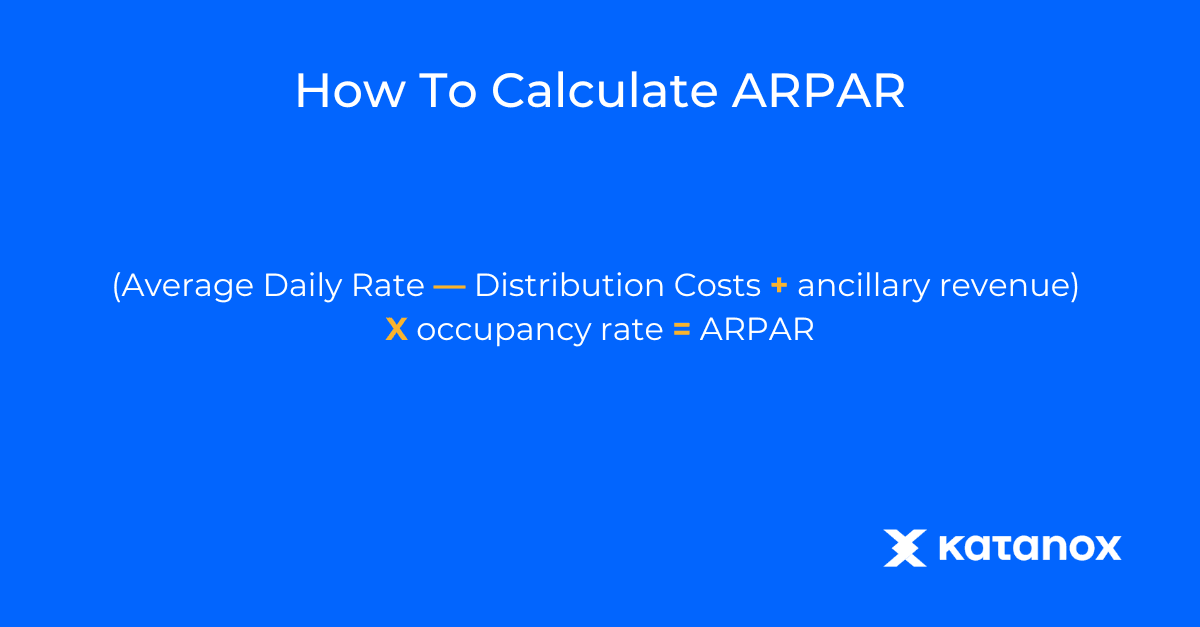

The equation for ARPAR we’ll use is as follows:

ARPAR = (Average daily rate - distribution costs + ancillary revenue) x occupancy rate.

Let’s go back to our example and plug in the variables. Using our ADR of 135 USD let’s subtract our average distribution cost of 35 USD and add our average ancillary revenue of 45 USD and multiply that by our 90% occupancy rate. This gives us an ARPAR of 130.50 USD.

Depending on what type of performance you are trying to gauge, will dictate what metric you need at what time.

Either way, it’s important to stay on the commercial pulse of your hospitality business by assessing both your revenue and the costs associated with bringing in that revenue.

To be successful in the hospitality industry, you must understand metrics like RevPAR and Net RevPAR.

With the constant winds of change sweeping across the travel industry of today, it’s vital to make informed decisions by having access to the right insights.

Want to dive deeper into optimizing your hotel's performance? Let our experts guide you. Get in touch today!