/ Blog

Learn the pros and cons of each payment method, the latest payment advances and developments, the best ways for hotels to execute their B2B payments.

Paul Beukers

Mar 12, 2024

This is the second part of our ongoing series covering hospitality payments. As part of our qualitative research, we interviewed several industry experts to understand the current ecosystem better, growing trends, common obstacles, best practices, and the future.

In this second part, we compare different payment methods and outline the pros and cons of virtual credit cards and direct payments.

Read Part 1: The Current B2B Hospitality Payments Ecosystem & The Need for Change

We now move on from the overview of the B2B payments landscape to how money is exchanged between business entities during a booking/transaction. There are predominantly two ways this occurs: either by (virtual) credit cards or by direct bank transfers.

We’ll discuss the pros and cons of each payment method, the latest advances and developments in payment, and the best ways for hotels to execute their B2B payments.

The Emergence of Virtual Credit Cards

The traditional ways in which credit cards are used are changing. One of the hot new payment options within the world of travel and fintech is virtual credit cards (VCCs). The global value of VCC transactions will reach $6.8 trillion in 2026, rising from $1.9 trillion in 2021.

For those unfamiliar, VCCs are temporary credit card numbers used to facilitate online transactions anywhere credit cards are an accepted form of payment. These add an extra layer of security as they are randomly generated disposable numbers instead of real account numbers.

In the hospitality world, VCCs have become a popular form of payment for B2B transactions, replacing corporate credit cards, and a common means of payment between OTAs and hotels.

It’s worth noting that other terms used are VCN (Virtual Card Number) or virtual card because these cards can technically be credit, debit, or prepaid. Credit and deferred debit cards have higher interchange fees than immediate debit and prepaid cards, as their level of risk is higher.

For the sake of simplicity, we'll refer to credit and deferred debit cards when mentioning VCCs since they are predominantly used in B2B hospitality payments.

"VCCs can be generated quickly with specific expiry dates and specific amounts to be drawn from them. They allow merchants to instantly confirm receipt of the funds," said James Brown, TrustedStays Head of Commercials & Partnerships.

"They protect the real card details of the consumer and they take the fraud/chargeback risk away from the small provider as the intermediary carries that liability."

Once a guest or person making the reservation has booked on a site such as Booking.com or Expedia, the booking site passes on the transaction via a virtual credit card.

The card, however, is only activated and ready to be charged later (typically on the check-in or check-out date). And this doesn’t just apply to credit card bookings. VCCs are used to transfer funds to the hotel for every form of payment used to make a reservation.

VCC Costs & Drawbacks

While there are many benefits of using VCCs, low fees and low error rates aren’t among them. In fact, hotels are incurring higher costs from these fees associated with VCCs.

Mews's blog post very eloquently represented this. Although this was written a few years ago, the problem not only still exists but has arguably gotten worse. Since 2015, within the EU, under PSD2 regulation, the interchange fees for consumer debit cards and consumer credit cards have been regulated and capped at 0.2% and 0.3%, respectively.

This safeguarded hotels within the EU against high interchange fees with consumer bookings. However, this regulation doesn’t apply to corporate cards, and the interchange fees are over 1.5% on average (more than five times as high!) when VCCs are used to pay out hotels.

Outside of the EU, these rates are typically even higher because there is no cap on corporate cards. This is because more actions need to be taken to process virtual credit cards than regular ones.

Also not to be forgotten are the typical credit card payment fees outlined in part one of our series. These include scheme fees, acquirer fees, and payment gateway fees and are tacked onto the high interchange fees. When all of these fees are combined, hotels pay, on average, 2.5-3% per VCC transaction.

Although cost is the major underlying issue with virtual credit cards, hotels must contend with other challenges. One of the biggest disadvantages is that virtual credit cards have limited use, which can vary depending on the booking website.

Smarthotel.nl summed up this problem perfectly on their blog, writing:

“In case the guest has additional expenses during the stay, you'll have to charge those to their real credit cards since the VCC only allows the booked rate to be charged. However, you must be careful not to overwrite the VCC details with the normal credit card details in the reservation system (PMS).

In other words, with virtual credit cards, you need to step aside from your normal payment process and adapt to the requirements of each booking site that offers VCCs. The administrative load might even increase due to it.”

However, we must clarify one point from Smarthotel.nl's article. It is possible to charge additional expenses to a VCC. A percentage can be added to the booked amount to cover items like incidentals. This is called incremental authorization or overcapture.

Therefore, not only are VCCs expensive, they can be a huge operational hassle — the exact opposite of what they are intended to do. Especially now, with hotels focusing on the complete customer journey and ancillary services, VCCs can put hotels at a disadvantage when trying to increase the total revenue per booking.

"I see the value VCCs bring to OTAs, and they can be helpful to hotels as well, but they come at a cost and create a bit more complexity for hotels to manage," said Mark Rademaker, Adyen Global Head of Hospitality.

The Case for Direct Billing (Payments)

Fortunately, there are B2B payment alternatives that hotels can use in place of VCCs. One such alternative is direct payments.

Direct payments, as the name suggests, are payments where funds are transferred from the bank account of an intermediary (such as a TMC or OTA) directly to a hotel’s bank account using an accredited payments vendor.

These payments are secured through KYC (Know Your Customers) and AML (Anti-Money Laundering) regulations. AML is a set of measures that financial organizations must implement to prevent financial crimes. One of the AML measures used by these organizations is KYC, which, as the name suggests, collects information about their customers and verifies their identities.

"I think direct billing is great at a high-level concept. The question is, what's the underlying technology behind it?" said Tim Russo, Navan Senior Director, Partnerships.

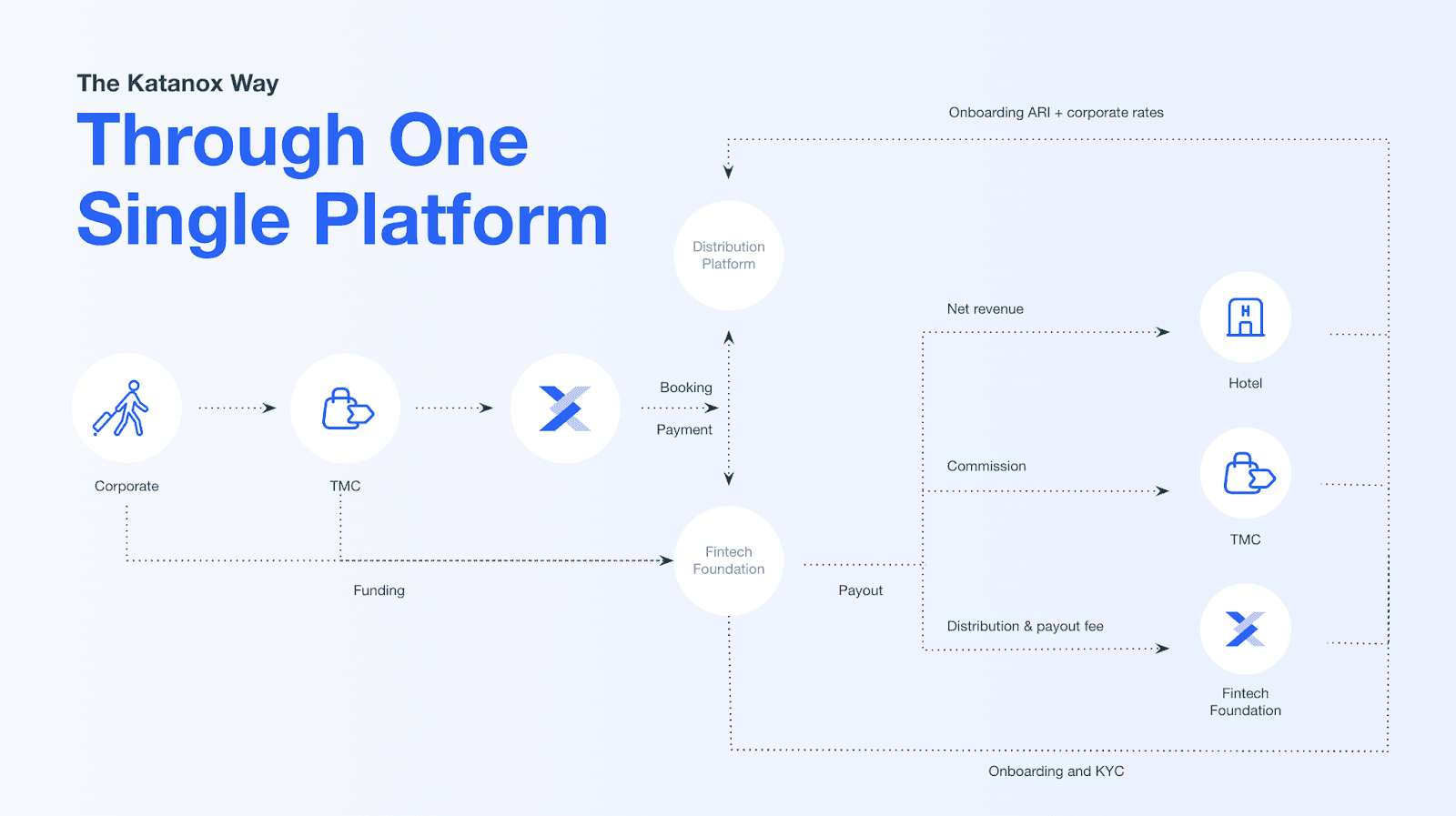

Russo makes a very good point because to make this process possible, a fintech provider must orchestrate this transaction. To illustrate how this works, we’ve outlined the process with our own fintech product.

Direct payments provide many advantages, including:

Simplicity

Transaction security

Lower transaction fees (for all parties involved)

Ownership of distribution

Trusted relationships between buyers and sellers

An escrow account is necessary to build a strong foundation and foster trust, the most important component of any partnership. This means that the money from every transaction never lands in the facilitator’s bank account and can only be used to pay bookings and commissions.

Fortifying this trust comes from companies such as Katanox meeting strict financial regulatory measures, meaning the money from hospitality transactions never hits these fintech providers' balance sheets.

“Direct payments provide a huge opportunity for hotels to get better," said Rademaker. "Hotels should challenge their booking engine providers to ensure that they are able to provide the best payment methods possible."

If you'd like to talk more about payments and improve your processes, contact us!