Blog

Company updates

The Current B2B Hospitality Payments Ecosystem & The Need for Change

The Current B2B Hospitality Payments Ecosystem & The Need for Change

Paul Beukers

Co-founder & CCO

Nov 14, 2023

This is the first part of our ongoing series covering hospitality payments. As part of our qualitative research, we interviewed several industry experts on the topic to better understand the current ecosystem, growing trends, common obstacles, best practices and what the future holds. In this first part, we examine the challenges of hospitality payments and how/why it needs to change.

Read part 2: Comparing Payment Methods: Virtual Credit Cards vs. Direct Payments

When it comes to hospitality payments, things are challenging — even in comparison to other travel industries. Because of these challenges, the process becomes complicated, opaque and costly.

We’ll talk more about how the current payment structure is a detriment to the hospitality industry and how and why it needs to change, but first, we’ll need to take a step back and understand the ecosystem as a whole.

A Complicated & Tangled Web

“The hospitality payments industry is really fascinating because of the multitude of players involved in the process of accepting and taking a payment, which makes it a complicated space to try and connect,” said Tim Russo, Navan, Senior Director, Fintech, Strategic, and Channel Partnerships.

“On the front end you have management systems (CMSs), essentially controlling the reservation. We at Navan are plugged into GDS players such as Sabre and Amadeus; additionally we partner directly with OTAs for even more inventory. All of those individual players are making sure that the rooms are available, taking payments and sending through the confirmation, etc.”

What makes the hotel industry so challenging is the complexity and fragmentation of its makeup.

“You have millions of hotels and they're organized in all kinds of different ways," said Paul van Alfen, Up in the Air Managing Director. "Some of them are wholly owned, some of them are franchises and some of them are chains. The hotels operate under one company, the brand is owned by another company, the buildings are owned by another company. So it's a very complex world out there."

To better understand how it all works. Let’s consider what happens during a single payment transaction.

As Hotel Tech Report details, a single payment can change hands up to seven times depending on the setup of the transaction. The potential parties include:

The Consumer - i.e. the guest, who is the cardholder or person/entity paying for the accommodation.

The Merchant - the business selling the services, i.e. the hotel.

The Payment Processor -the link between the hotel, the credit card network, and the guest's bank.

The Credit Card Network - depending on the guest’s method of payment this is predominantly American Express, Visa or Mastercard.

The Issuing Bank - the guest’s bank, which makes the payment.

The Acquiring Bank - the hotel's bank, which receives the payment.

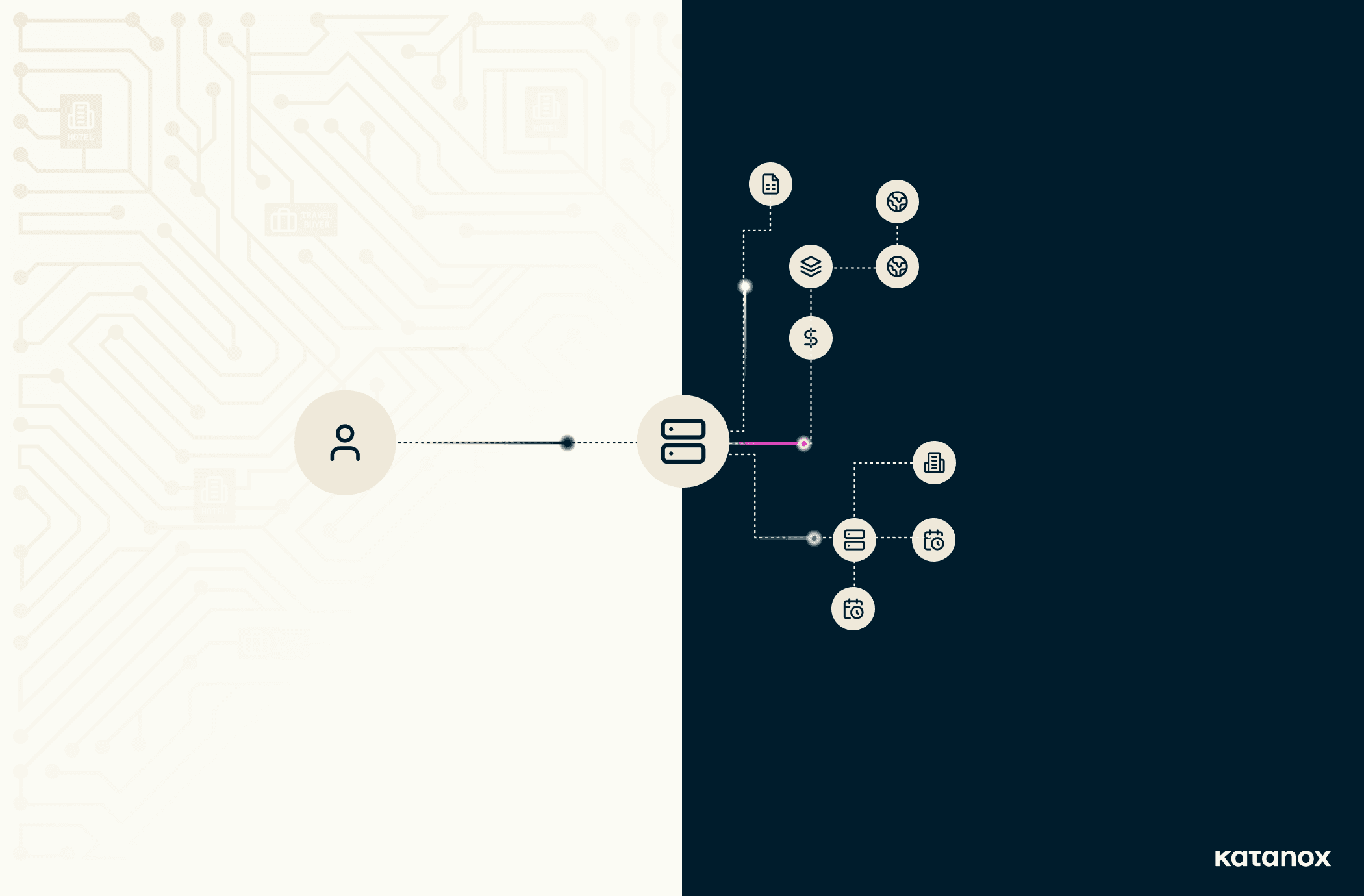

If we look at payments from a B2B perspective, there’s a whole lot more going on between the guest and the hotel. The process is broken down below by van Alfen’s Up in the Air consultancy.

As you can see from the above graphic, the payment process in the hotel industry has many layers and intermediaries involved to simply complete a transaction. Each step along the way provides another opportunity for a charge to be applied, which can add up to a high amount of fees for the hotel, even if each charge is a small percentage. We’ll touch on that in more detail in the following section.

“From a payments perspective, there's really two elements to it depending on the region of the world that you're in,” said Russo. “There are regions of the world where it's more invoicing based. The travel suppliers (the TMC or OTA) are buying reservations upfront on behalf of their travelers or customers and then invoicing them, as an example, on a 30-day bill back period. We are seeing less of that because it's becoming more common to accept credit cards in B2B.”

We’ll cover types of payments and their associated pros and cons in part two of our series. For now, let’s have a closer look at the costs.

The Cost of Doing Business

So what is the end result of this convoluted hospitality structure? A lot of costs for hotels.

With margins in the hospitality industry already at razor-thin levels, these extra costs really add up and are a huge blow to business.

As a matter of fact, Planet reports that nine out of 10 hotels are affected by the cost of living crisis and 64% are now passing on increased costs to guests.

When it comes to transaction costs, there is a lot to consider, especially the more granular you get, but these are the primary fees hotel must contend with:

When it comes to processing cards, hotels must pay a merchant service charge (MSC). The MSC has three main components:

Acquirer Fees: also known as acquirer markup or processing fees. These are fees charged by the merchant acquirer. These fees can vary widely but most sit between 0.3%-1.0%.

Interchange Fees: these are the card transaction fees that card acquirers pay to issuers each time a card is used to pay for accommodation. These fees start at a few tenths of a percent and go up from there.

Scheme Fees: fees charged by a card scheme (Mastercard, Visa, American Express etc.). Both interchange fees and scheme fees are typically higher on a commercial card compared to a consumer card.

Additionally, hotels have to pay Payment Gateway Fees: a third-party service enabling merchants to process both in-person and online payments (Stripe, Square, etc.). An example of a fee structure would be 15 cents per transaction. There is sometimes an additional monthly service cost as well.

Although there is clearly a need for it, because of the complicated and expensive nature of hospitality distribution and payments, the industry has been slow to change.

“If you look at other global companies, there’s a lot of advances being made in how payments are done, whether it’s routing transactions, orchestration or other things,” said Mark Rademaker, Adyen, Global Head of Hospitality.

“But, what hotels still want to do is have reconciliation, largely done at the property level. That creates several restrictions on their ability to get the cutting edge of what payments can actually do for them, so they're kind of handcuffed to that.”

However, this doesn’t mean the industry cannot — nor will not — change.

The Path Forward

While we’ll cover this in greater detail in upcoming parts of our content series on payments, we did want to touch on a high level where the industry is heading and how the payments ecosystem can be improved.

One of the biggest changes we are experiencing is how hotels are thinking about payments in terms of their overall business.

“In the hospitality industry we’re now thinking of payments as part of the strategy as opposed to being an afterthought,” said Rademaker. “Now payments are moving to the forefront of the conversation to think about how it is a foundational piece of technology and the tech stack that hotels are implementing.”

There’s been a lot of innovation in payments and fintech on the consumer side, but not specifically within B2B hospitality.

“Most of the innovation happens on the payment side with a lot of consumer-facing stuff happening there,” said van Alfen. “But there’s a lot of ground to cover and there’s a lot of momentum to streamline the B2B side.”

However, that could all be changing as the industry is finally on the verge of digital transformation led by fintech.

“As sector convergence and the lines between industries are blurred, further fin-tech Integrations mean that more processes can be automated for guests, travel agents, suppliers, owners, and employees,” said James Brown, TrustedStays Head of Commercials & Partnerships.

“The ability to mass process reservations in real-time will ensure cashflow for business, maintain security against fraud and create a highly efficient eco-system for consumers and suppliers to exploit machines efficiency and accuracy to enhance both customers experience and ease of use.”

In the next section of our payments series, we’ll have a closer look at types of payment methods, specifically taking a look at virtual credit cards and direct payments and comparing the two.

If you'd like to talk more about payments and improve your own processes, reach out to us!

Paul Beukers

Co-founder & CCO

Share

Newsletter

Content

Artificial Intelligence (AI) in hospitality: building the infrastructure for an agentic future

Dec 3, 2025

Company updates

Katanox and Selfbook partner to power intelligent, AI-driven hospitality commerce

Nov 20, 2025

Company updates

Automation & streamlined processes are the answer to hospitality’s payment & reconciliation challenges

Aug 27, 2025