Blog

Content

The need for financial infrastructure in hospitality: empowering hotel franchisees

The hospitality industry needs its own financial infrastructure to empower hotel franchisees.

Katanox

Company

May 14, 2025

For owners in most sectors, numerous tools are well-integrated to quickly get a business up and running, allowing the owner to focus on core operations. This is because proper infrastructure has been built, including a means to easily accept payments and receive funds, providing businesses with strong foundational support.

However, the same cannot be said for a hotel owner. Due to the hospitality industry's characteristics and legacy, the sector’s traditional tech stack creates fragmentation issues and unnecessary complexity. The result is that hotel franchisees are bogged down with administrative overhead instead of focusing on their core business competencies, which hinders growth and efficiency.

This is why the hospitality industry needs its own financial infrastructure to empower hotel franchisees.

Problem: Fragmented datasets & solutions

Before we discuss the solution, let's examine the growth blockers to hospitality's growth to gain a comprehensive understanding of the problem.

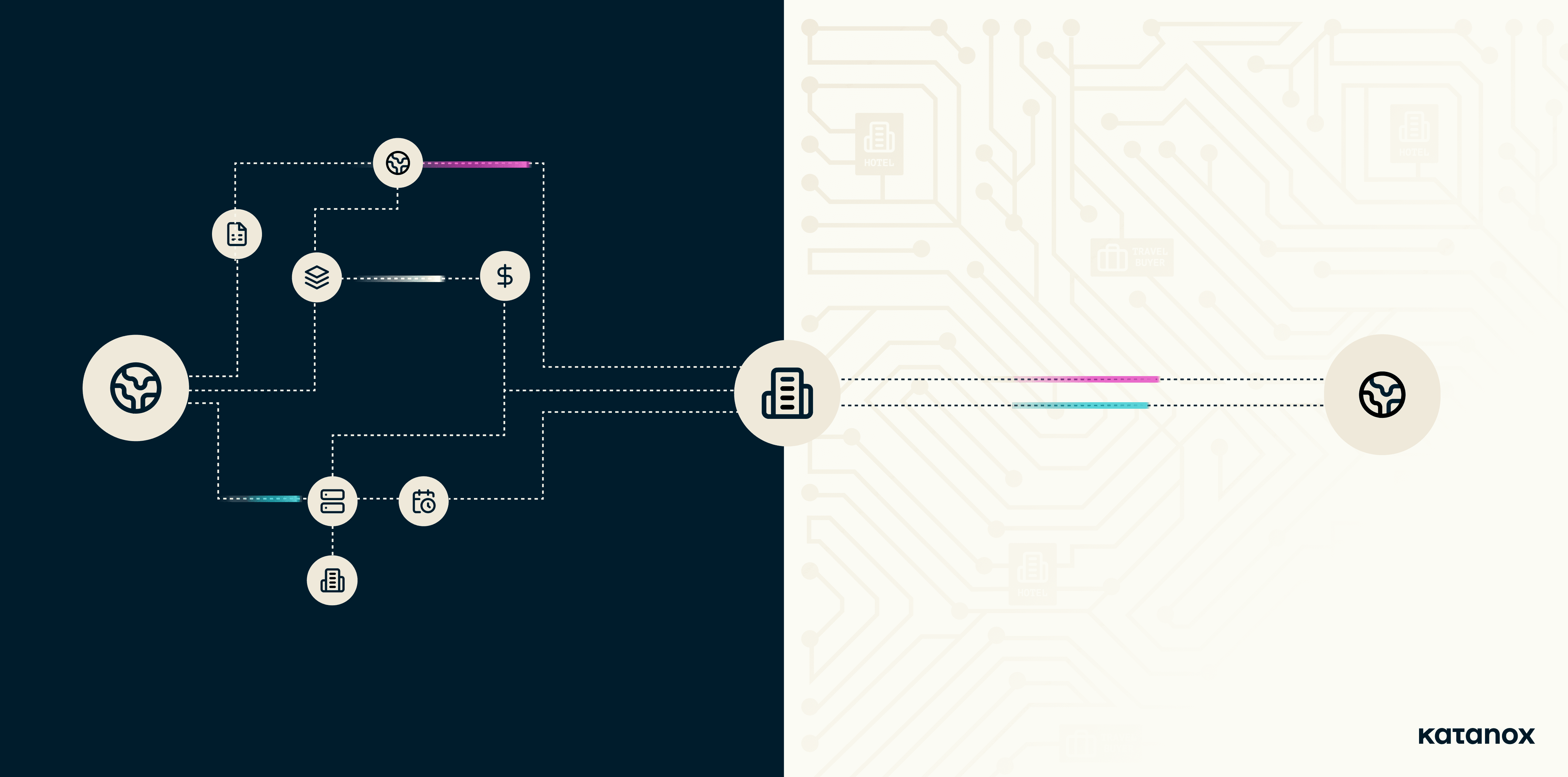

A typical hotel transaction looks something like this:

A hotel guest makes a booking.

The travel Buyer sends a booking request to the accommodation supplier.

The travel buyer creates a VCC and sends payment to the accommodation supplier.

The accommodation supplier will (hopefully) receive a payout from VCC.

The accommodation supplier settles the commission with the travel buyer.

This simplified version does not fully capture the complexity of the process. For a hotel to execute its necessary business operations, four to six separate companies are typically required, encompassing distribution and booking, payments, and reconciliation. Managing multiple integrations and datasets across distribution, payments, and rate management creates challenges for both accommodation suppliers and buyers.

This means hotels are missing out on net profits and extra revenue opportunities, working inefficiently, and negatively impacting the customer experience. For example, according to Poppink TRVL Projects, up to 25% of all VCC transactions fail during check-in, creating a poor guest experience.

Multiple reports describe how payments and financial tasks create unique challenges for hotel franchisees.

According to a Modulr survey, which consulted 551 travel sector payment leaders in the UK, France, Spain, and Italy, 44% of businesses waste over 1.5 hours per person per week on payment processing inefficiencies due to fragmented payment systems. Most businesses (64%) execute supplier payments in bulk rather than automatically, increasing operational complexity.

Edgar, Dunn & Company (EDC) estimated that in 2024, the hotel industry will spend $21 billion on direct payment acceptance costs alone, creating lost revenue opportunities due to payment-related booking difficulties.

One of the key problems EDC references is the payment fragmentation (decentralization) created by the hotel industry's ownership structure, compared to other sectors where brands typically maintain direct operational control. This leaves each property to manage its own relationships with tech vendors, acquirers, and banks.

For example, EDC references a statistic from Skift — franchise arrangements dominate 93% of the market in mature regions, such as the U.S. At the same time, management companies represent a significant portion of the remaining share.

Within this structure, individual franchises are responsible for:

Payment processing

Fraud management

Chargeback handling

Financial reconciliation

These financial-related tasks can significantly burden and divert time and focus from core business operations and strategic planning.

According to Adyen, 31% of hotels reported that reconciliation and associated administrative work hindered their business ambitions. On average, five employees support reconciliation, spending 7 hours weekly on it.

Franchisees must have access to new tools to succeed in today's technology-driven landscape.

Solution: Provide hospitality with a streamlined financial infrastructure

Finance is the connecting tissue of hospitality, encompassing payments, settlement, and reconciliation, as well as booking and contracting. Money must move frictionlessly from the traveler or corporate customer to the travel buyer, ultimately arriving in the hotel's bank account while adhering to strict governance and regulatory requirements.

Deploying financial infrastructure is the foundation for running a successful hotel today. By consolidating payment processes with other core business operations, such as connectivity, contracting, and booking, hotels can enhance organizational efficiency, increase net profits, and improve the guest experience by eliminating travel friction caused by failed payments.

Now, let’s revisit the transaction flow with proper financial infrastructure:

A hotel guest makes a booking.

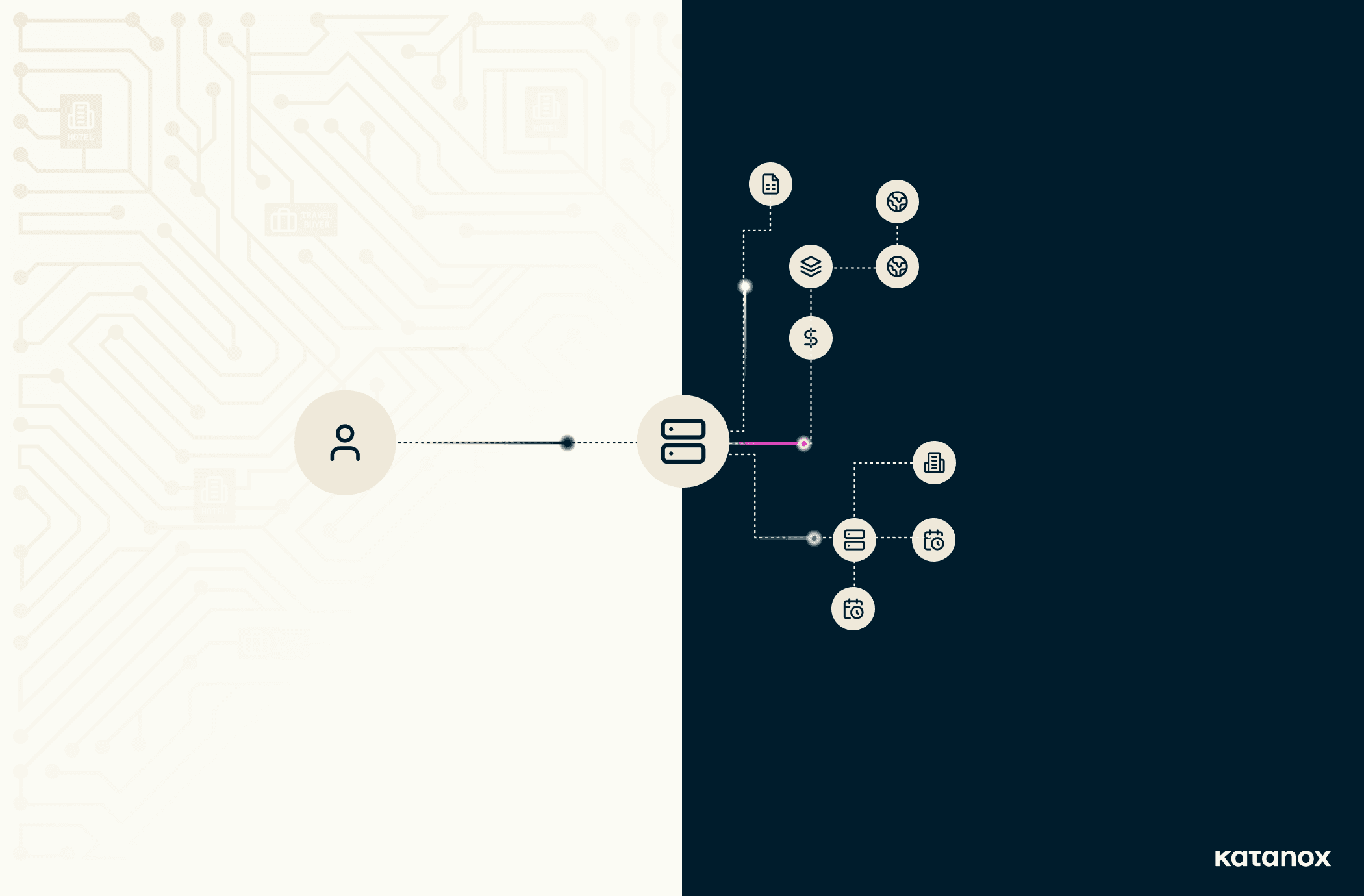

The travel Buyer sends a booking request through Katanox to the accommodation supplier.

Katanox settles the money between the Travel Buyer and the accommodation supplier. The travel buyer pays these funds upfront to the Katanox escrow account.

Numerous integrations can now be consolidated into one single platform, eliminating unnecessary complexity, improving security, and reducing potential errors. For example, Katanox brings traditionally siloed and bespoke parts of the hospitality business into one single platform: payments, reconciliation, direct contracting, and connectivity, providing the necessary financial infrastructure for hotel franchisees to run their business seamlessly.

Other benefits for hotel franchisees include:

Cost Savings: Katanox provides direct bank transfers, a significantly cheaper option than VCC payments.

Quicker payouts: A fast and streamlined reconciliation and settlement process means franchisees get paid quickly, freeing up valuable cash flow.

Improved efficiency: Reducing payment failures and unifying the reconciliation of partner commissions and settlements enhances efficiency, reducing the administrative load on hotel staff and allowing them to focus on core business operations.

To accelerate adoption and tech unification, hotel brands must provide franchisees with the necessary technology, educate them on its benefits, and, together with their tech partner, streamline the onboarding process for their properties.

By providing franchisees with digital innovation and on-property technology tools that drive operating efficiencies, reduce costs, and drive owner ROI, hotel brands can position themselves as the preferred choice among franchisees.

Financial infrastructure creates the road to scalable growth

The efficiency and scalability of core business operations are crucial for an organization's health, cash flow, and revenue generation, especially in the hospitality sector.

A hotel brand’s number one goal should be to reorganize its tech stack and eliminate the complexities and friction created by legacy systems and processes.

By providing the latest digital innovations and driving adoption, hotel brands can attract new franchisees and position existing ones for success now and in the future as the industry evolves, such as with the advent of AI travel agents.

By providing financial infrastructure for the hospitality industry, accommodation suppliers and buyers can manage direct contracting, connectivity, payments, and reconciliation on one platform. All aspects of hospitality business operations can be simplified and integrated to eliminate tech fragmentation and data silos. The result is greater efficiency, higher net profits, improved customer experience, and increased brand value.

We are at a unique intersection in the hospitality industry. While there are significant challenges, there are even greater opportunities. If hotel brands provide the right technological tools, they can empower franchisees to run their properties more efficiently and profitably.

Katanox

Company

Share