Blog

Company updates

Katanox Secures PSD2 Licence to Offer Regulated Payment Services as Part of Its One-Platform Approach

Katanox Secures PSD2 Licence to Offer Regulated Payment Services as Part of Its One-Platform Approach

Paul Beukers

Co-founder & CCO

May 2, 2024

Hotels and accommodation buyers can book and transact via direct bank payouts, providing a better and trusted alternative to expensive virtual credit cards.

Amsterdam, The Netherlands, May 2, 2024 — Katanox, the hospitality distribution and fintech platform, announced that it has secured a PSD2 payment institution licence from the Dutch National Bank.

As a payments licence holder, Katanox Financial Technology B.V., a company within the Katanox group, offers regulated payments services across the European Economic Area (EEA).

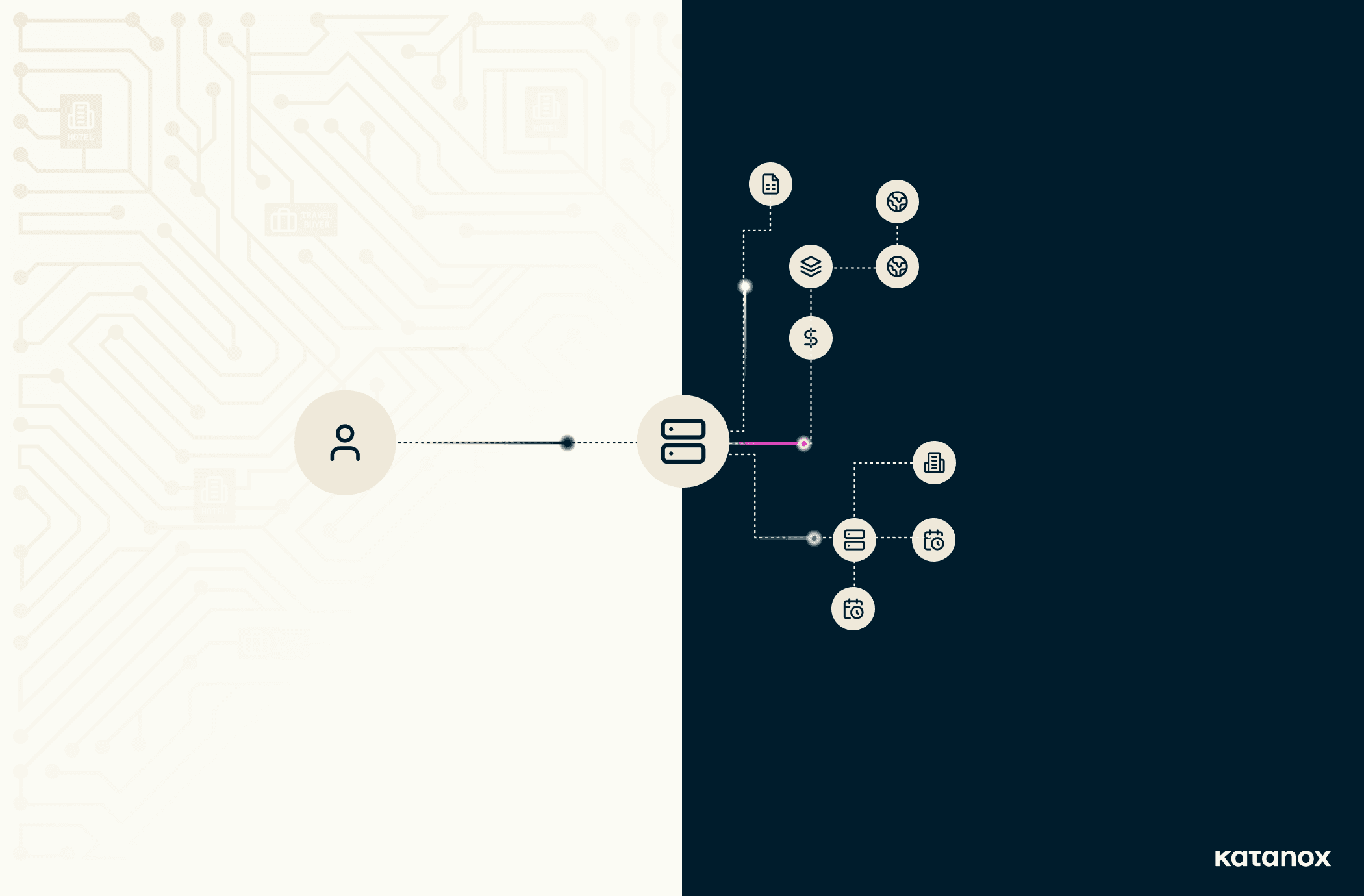

This means that accommodation providers and accommodation buyers can book and transact via direct bank payouts all within one platform.

The entire process is streamlined within Katanox’s platform from distribution and booking to automated commission reconciliation and payouts, meaning every penny within the transaction is accounted for.

Not only does this give hotels and accommodation buyers more efficient workflows, control and transparency, it also provides a better alternative to virtual credit cards (VCCs).

As is outlined in Katanox’s payment series, VCCs, although offering some benefits, come with high fees and are prone to errors. When all of these fees are combined, hotels are paying, on average, 2.5-3% per VCC transaction.

The B2B payments alternative to VCCs are direct bank payouts. Direct payments provide many advantages, including:

Simplicity

Transaction security

Lower transaction fees (for all parties involved)

Ownership of distribution

Trusted relationships between buyers and sellers

“The granting of this licence is an enormous next step in our one platform approach to provide accommodation buyers and sellers the most efficient and cost-effective products to distribute and transact properties and rooms,” said Paul Beukers, Co-founder Katanox.

“This is simply the beginning as we will expand our payments offerings into more markets and build more products both horizontally and vertically to deliver unprecedented opportunities to the hospitality industry.”

Paul Beukers

Co-founder & CCO

Share

Newsletter

Content

Artificial Intelligence (AI) in hospitality: building the infrastructure for an agentic future

Dec 3, 2025

Company updates

Katanox and Selfbook partner to power intelligent, AI-driven hospitality commerce

Nov 20, 2025

Company updates

Automation & streamlined processes are the answer to hospitality’s payment & reconciliation challenges

Aug 27, 2025